How well your A/R Follow-up process works directly affects your cash flow. Thus, it is critical that the follow-up be founded on a robust governance structure and is carried out with diligence. With careful analysis, rigorous follow-up, and the development of business rules that outline the best course of action for each case, Trimark Global assists clients in increasing their cash flow.

- Construct Work Queues. We make work queues for our agents to follow up on when we examine the A/R ageing buckets.

- In effect Observe and respond. We identify the day after submission that works well for various payers and concentrate on those who have data on file.

- Multiple channels Make contact. These days, a lot of payers offer information through their IVR and website. By registering with payers, we assist our clients in enhancing website adoption. As a result, calling requires less work, and only claims that need further investigation are called upon.

- Diminish DSO. Our thorough follow-up lowers the number of Days Sales Outstanding. We can find out the claim's status, find out which claims have been rejected, and file appeals.

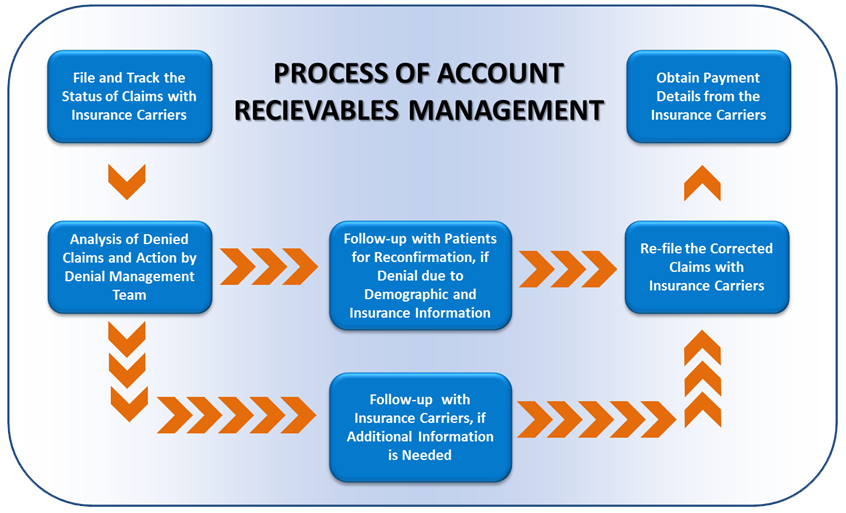

Components of our A/R Management Process

- Healthcare providers sometimes encounter scenarios involving millions of dollars' worth of accumulated unsettled accounts payable. Situations like these could occur as a result of a system switchover or inefficient A/R clearance.

- In order to resolve the A/R, we conduct a comprehensive analysis, formulate a targeted plan, collaborate with the client to establish goals for collection, establish a procedure for negotiating with insurance companies, and pursue each claim through several follow-ups in an effort to retrieve the maximum amount of money.